Table of Content

HDFC also offers a facility of a pre-approved home loan even before you have identified your dream home. A pre-approved home loan is an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position. If you purchase an under construction property you are generally required to service only the interest on the loan amount drawn till the final disbursement of the loan and pay EMIs thereafter.

Personal satisfaction—The feeling of emotional well-being that can come with freedom from debt obligations. A debt-free status also empowers borrowers to spend and invest in other areas. Lower interest costs—Borrowers can save money on interest, which often amounts to a significant expense. Other costs—includes utilities, home maintenance costs, and anything pertaining to the general upkeep of the property. It is common to spend 1% or more of the property value on annual maintenance alone. HOA fee—a fee imposed on the property owner by a homeowner's association , which is an organization that maintains and improves the property and environment of the neighborhoods within its purview.

Malaysia Home Loan Calculator

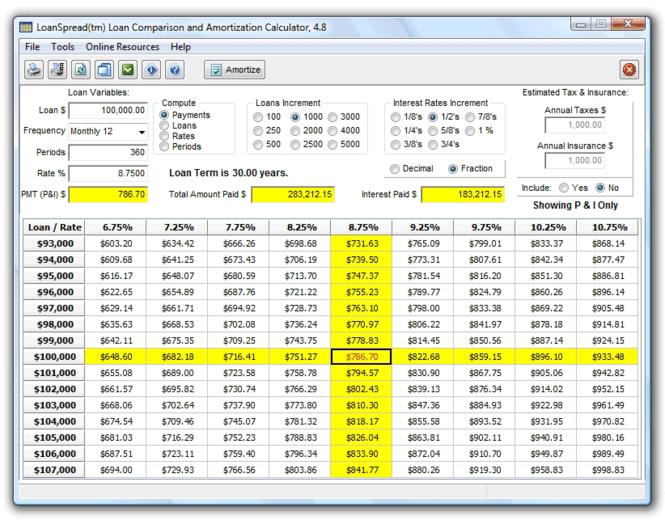

Loan amount and loan tenure, two components required to calculate the EMI are under your control; i.e., you are going to decide how much loan you have to borrow and how long your loan tenure should be. But interest rate is decided by the banks & HFCs based on rates and policies set by RBI. As a borrower, you should consider the two extreme possibilities of increase and decrease in the rate of interest and calculate your EMI under these two conditions. Such calculation will help you decide how much EMI is affordable, how long your loan tenure should be and how much you should borrow.

Some communities, such as condominiums and townhomes, are governed by a homeowner's association that maintains communal areas and enforces rules and regulations for a monthly fee. Any HOA dues you pay each month can affect your affordability. You can edit this number in the affordability calculator advanced options. If you are planning for a long-term investment with high returns, you can choose to invest in FD after calculating the interest earned on the fixed deposit calculator. The FD schemes are good investment options for those who have surplus money and want to start investing. You can plan your savings with the FD calculator monthly interest.

Pay

Use the home pre-qualification calculator to see how much spending power you have when you’re first starting to shop around. Our refinance calculator shows different payment options for multiple fixed-rate mortgage terms. In addition to these three, we also have cash-to-close, net proceeds, and pre-qualification calculators. Our mortgage amortization schedule makes it easy to see how much of your mortgage payment will go toward paying interest and principal over your loan term. Home loan calculator is used to calculate the monthly mortgage payments for your home. This home mortgage calculator has many options that may be applicable for you such as PMI, tax and insurance, extra payments to calculate the costs of buying and financing a house.

Condominiums, townhomes, and some single-family homes commonly require the payment of HOA fees. Annual HOA fees usually amount to less than one percent of the property value. An online EMI calculator is easily accessible online from anywhere. You can try various combinations of the input variable as many times as required to arrive at the right home loan amount, EMIs, and tenure best suited to your needs. After getting an estimate of EMI using the calculator, you can apply for a home loan online from the comfort of your living room easily with Online Home Loans by HDFC. Home Insurance is the yearly premium you pay to insure your home—if it isn’t already covered by loan insurance plan.

Unsecured Loans

Complete Guide to FHA LoansConsidering an FHA loan for your new home? Read about FHA loans and find out why they’re a popular option for first time homebuyers. You should consult with your insurance carrier, but the general thought is that homeowner's insurance costs roughly $35 per month for every $100,000 of the home value. In addition to mortgages options , consider some of these program differences and mortgage terminology.

This is because EMIs are computed on a reducing balance method, which works in your favour as a borrower. Use home loan EMI Calculator to calculate monthly EMI based on sanction or desired amount, rate of interest and tenor. This online tool will give you ratio of housing loan principal amount & interest to be paid. Also check lowest EMI and highest EMI based on repayment period.

Have an idea of what kind of loan is right for you before you apply. By 2001, the homeownership rate had reached a record level of 68.1%. It is a loan to extend or add space to your home such as additional rooms and floors etc. Transferring your outstanding home loan availed from another Bank / Financial Institution to HDFC is known as a balance transfer loan. Home Value is the actual price of the home you purchased (i.e., sale deed value). SBI Frequently asked questions , has listed questions and answers, all supposed to be commonly asked in context of Home Loans.

To calculate amortization with an extra payment, simply add the extra payment to the principal payment for the month that the extra payment was made. Any additional extra payments throughout the loan term should be applied in the same way. Keep in mind, while you can pay off your principal early, in some cases there may be a pre-payment penalty for paying the loan off too early. If you have some combination of good to excellent credit, a low debt-to-income ratio, steady income and assets, you can probably qualify for most types of loans.

If your loan amount is greater than 80% of the home purchase price, lenders require insurance on their investment. Your loan program can affect your interest rate and total monthly payments. Choose from 30-year fixed, 15-year fixed, and 5-year ARM loan scenarios in the calculator to see examples of how different loan terms mean different monthly payments. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage. HDFC’s EMI calculators give a fair understanding about the ratio of the principal amount to the interest due, based on the loan tenure and interest rates.

Adjust the calculator to estimate your monthly mortgage payment. If your down payment is less than 20 percent of the home's purchase price, you'll probably be on the hook for mortgage insurance, which also is added to your monthly payment. A student loan is an unsecured loan from either the federal government or a private lender.

Nearly all loan structures include interest, which is the profit that banks or lenders make on loans. Interest rate is the percentage of a loan paid by borrowers to lenders. For most loans, interest is paid in addition to principal repayment.

The payment schedule also shows the intermediate outstanding balance for each year which will be carried over to the next year. It is highly recommended that you speak with a lender or loan professional of your choice about your mortgage loan needs and to help determine your home affordability. Realtor.com provides information and advertising services – learn more. The Veterans Affairs Department is an agency of the U.S. government.